Insurance plays an essential role in our lives. Unfortunately, unscrupulous actors sometimes take advantage of consumers who only wish to be treated fairly. State laws impose specific responsibilities on both insurance companies and insurance agents protecting the public from any potential abuse or misrepresentation.

If you were recently denied while filing a claim for insurance benefits that you believe to be covered, then there may be a chance of misrepresentation. Misrepresentations can be committed by insurance adjusters and agents. An insurance agent can misrepresent details of the policy you are buying to induce you into a purchase. An insurance adjuster may misrepresent the terms of the policy so you accept less to settle your claim. If an agent or adjuster has made misrepresentations to you, then you may be entitled to damages, statutory penalties, and attorney’s fees.

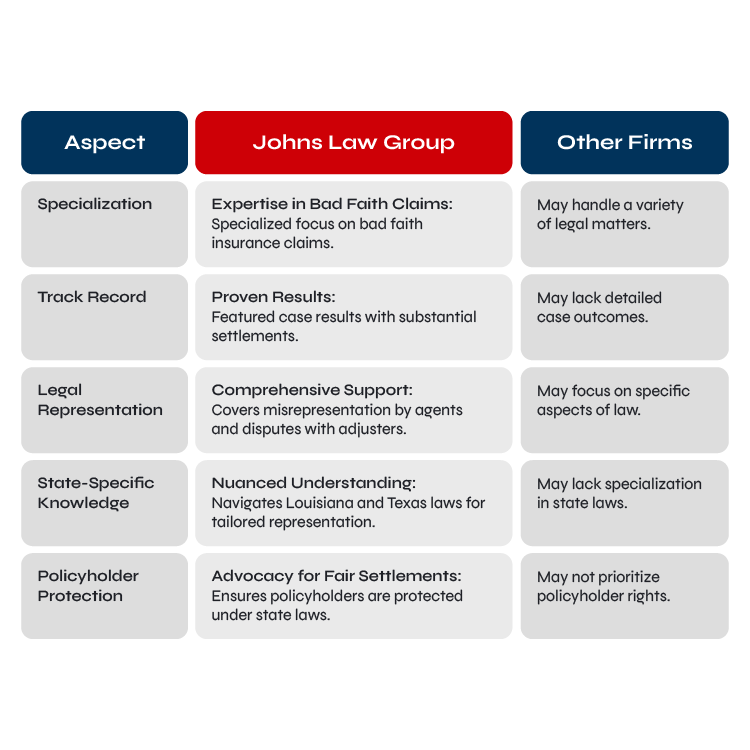

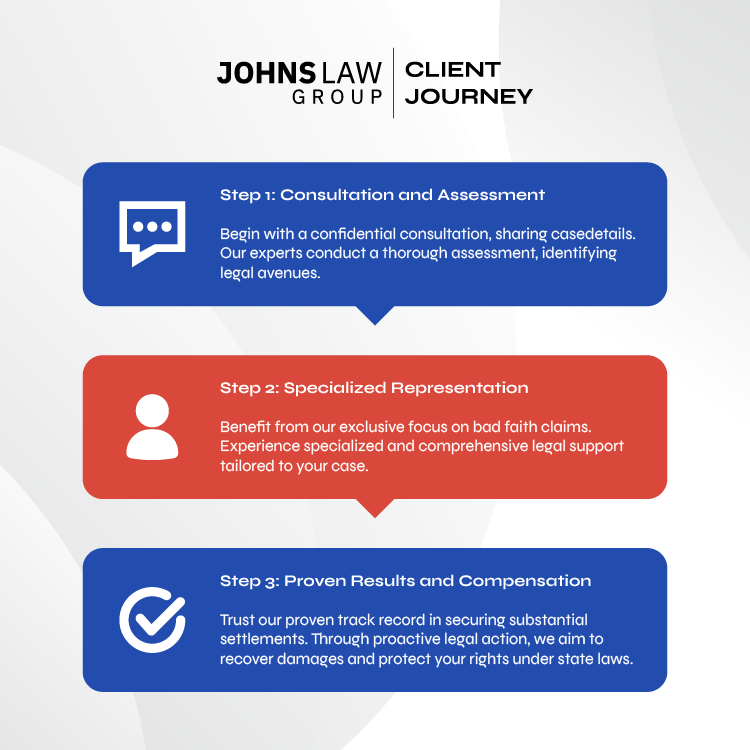

Johns Law Group has experience pursuing bad faith insurance claims to recover all of the benefits our clients are entitled to.

Our Featured Case Results

Misrepresentation by an Insurance Agent

The insurance claim process is typically straightforward: you file a claim with your insurance provider. They investigate your claim to confirm what coverage you are owed. Insurance companies and adjusters use the terms of your insurance policy and the circumstances and facts of your claim to estimate an appropriate coverage amount.

We rely on insurance agents to purchase the insurance that we request and provide information about the coverage that is available. Often, we get opinions from our agents about the insurance that we need. Because the agent is a trained professional, it is reasonable to rely on their advice. Some agents may take advantage of this position of trust or simply disregard the requests of their customers. The agent may improperly represent the policy, including specific terms, provisions, or requirements for coverage that are not outlined in the policy.

When you have been misinformed about your insurance policy, you may not be properly insured. You may file a claim without knowing that you don’t have coverage for your loss. The insurance company can deny your claim and point to language in the contract you were unaware of. In that case, you may have an insurance bad faith claim.

If your claim is denied or underpaid because an agent was negligent or made misrepresentations to you, you may be able to recover damages against the agent.

Misrepresentation from an Insurance Adjuster

It is in the best interest of an insurance company to pay out low settlements, so it is not uncommon to receive an initial low estimate for a settlement offer. You should prepare to negotiate with an insurance company after you’ve received a low offer. You can review what you initially filed with the insurance adjuster to see if you can add any additional information to your claim.

People often rely on the statements by an insurance adjuster when deciding to settle their claim. Insurance adjusters sometimes misrepresent what your policy covers in the hope that you will close your claim for less. An adjuster may take advantage of the policyholder by being untruthful about what the policy means. This is not just an unethical business practice. It is fraudulent.

If you believe your insurance adjuster or company has misrepresented your policy, you may be entitled to additional damages for insurance bad faith. In some cases, you may recover a penalty equal to 300% of your claim’s value plus attorney’s fees. If you believe you are the victim of bad faith insurance practices, call an attorney to review your case.

Negligent Insurance Agent Duties and Actions

The main duty of insurance agents is to sell the insurance coverage that the policyholder requested. In the process of marketing insurance products, agents will often make representations and also provide advice about the insurance that you need. If an insurance agent is going to offer advice, they must avoid providing negligence advice and misrepresentating the insurance that is being sold. In general, suing someone for a negligent misrepresentation claim requires you to prove the following elements:

- The person you are suing has a duty to act or refrain from acting in a certain way.

- The person breached or failed in their duty toward you.

- The person’s breach of duty caused you harm that could have been foreseen.

- That you suffered actual damages such as property damage, lost wages, or medical expenses.

It’s important to note that specific duties for insurance agents and adjusters differ in each state’s laws. The following actions amount to insurance agent negligence in Louisiana and Texas:

- Agents failed to sign you up for the available coverage that you requested.

- Agents that misrepresent the details of your insurance policy

- Agents that misrepresent the insurance application

- Adjusters that fail to process your insurance claim with the actual insurer or claims department

- Agents that fail to notify you that your insurance contract is about to be canceled, especially if the insurer is canceling prematurely

- Insurance companies that fail to notify you of any possible insurer financial issues like insolvency

Regardless of their intentions, the negligent person is legally responsible for the damage caused. Agents who are experts or specialized have a high duty of care. Neglecting your needs could jeopardize the insurance coverage you thought you had or lead to a claim denial by the actual insurer. Insurance agent negligence should be treated seriously, and you may have a negligent misrepresentation claim.

Compensation for Insurance Provider Negligence

In a bad-faith lawsuit, the compensation you receive is also known as damages. There are limitations to the damages you can recover depending on the state. If you were denied coverage because of negligence from an insurance adjuster or agent, you may be entitled to the full sum of what you would have received and damages for the inconvenience of being denied the expected coverage.

Misrepresentation is Bad-Faith and Policyholders are Protected

In many states, including Florida, Louisiana, and Texas, there are laws designed to protect policyholders like you from insurance adjusters and agents that misrepresent information. These laws guarantee that all insurance claims are investigated and settled fairly and promptly.

In Louisiana, there are six ways an insurance company can act in bad faith:

- Misrepresenting insurance policy provisions or facts relating to your coverage

- Failing to pay a settlement within 30 days after signing an agreement

- Denying coverage or attempting to settle a claim with an altered policy that the holder was not notified of

- Misleading claimants

- Failing to pay any claim due after receipt of proof of loss

- Failing to pay claims

Contact a Florida Bad Faith Insurance Lawyer

Negligence by an insurance adjuster or agent can have a significant impact on your financial circumstances. Proving negligence is complex and nuanced and has strict time frames to act.

If you believe your insurer has misled or misrepresented your coverage, contact a Texas and Louisiana bad faith insurance lawyer at Johns Law Group. Our qualified insurance attorneys have the experience you need to advocate for you.