Stuck in an Insurance Dispute? Insider Advice From Louisiana Insurance Litigation Attorneys

Like most policyholders, you have diligently paid insurance premiums for years with the expectation that the insurance company will pay your claim when the time comes.

Now that you’ve suffered a loss, your insurance company denies or is underpaying your claim.

If this describes your case, you need an insurance litigation attorney in Louisiana to help resolve your insurance dispute.

Our Louisiana insurance lawyer represents clients who have been bullied by big insurance companies.

We relentlessly work to get our clients maximum insurance settlements in all sorts of claims, including damage caused by hail, wind, fire, and floods.

If you would like to schedule a free consultation, please call us at (866) 577-2701.

We are located at 3500 N. Hullen Street, Metairie, LA 70002.

COMMON TYPES OF LOUISIANA PROPERTY INSURANCE DISPUTES

At MIC Firm, we handle the following types of insurance disputes:

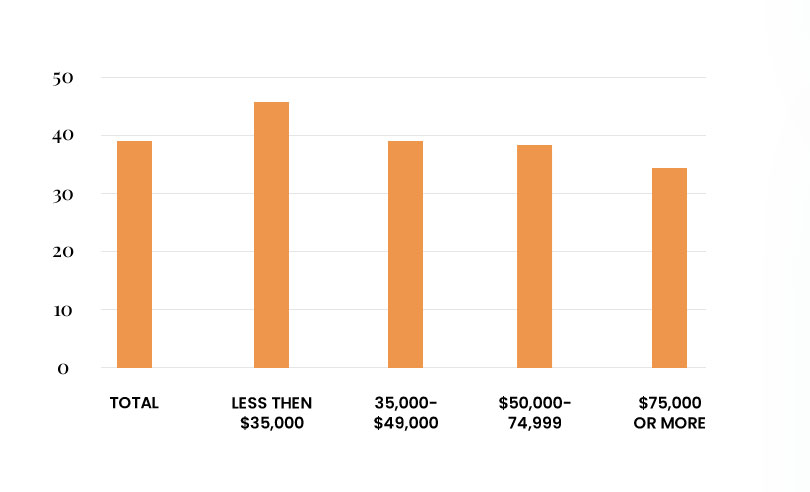

MEDICAL BILL AND HEALTH INSURANCE DISPUTES IN 2016

Contact our office for a free analysis of your type of insurance dispute.

Here, you’ll find information about insurance disputes, including the following points:

Keep reading to find out why your insurance company denied, delayed, or underpaid your claim, and how you can protect your rights.

If you need help right away, give us a call.

Maybe you need more information before contacting a Louisiana insurance lawyer; we have that too.

COMMON CAUSES OF LOUISIANA INSURANCE DISPUTES

While you may feel frustrated with your insurance company, know that you’re not alone. Insurance companies are in the business of turning a profit, often at customers’ expense.

Here are common causes of insurance disputes:

Coverage Limits and Exclusions

Insurance policies often include vague and unclear wording aimed at limiting your insurance coverage.

It is not uncommon for insurance companies to interpret an insurance policy in a strained manner to unfairly deny your claim or limit your financial recovery.

Insurance companies often will not provide their customers with clear reasons why their insurance policy does not provide the insurance coverage they deserve.

Loss Assessments (Underpaid Claims)

Do you and your insurance company have differing opinions on the monetary value of your loss? Do not worry.

This is incredibly common. Insurance adjusters often undervalue a loss to make it hard for you to financially recover.

We fight hard to maximize your recovery for your damages and losses.

Communication Problems

You may have trouble communicating with your insurance company.

Perhaps they deflect your questions, don’t respond to emails, or fail to return calls.

Unfortunately, the sad truth is insurance companies are more likely to respond to a Louisiana insurance lawyer than its own customers.

If you have difficulty communicating with your insurance company, our insurance dispute attorneys can take over that challenge.

REASONS AN INSURANCE COMPANY DENIES CLAIMS

An insurance company may try to deny your claim on any grounds possible.

After all, finding a way to deny your reimbursement helps their bottom line. Insurance companies use corporate lawyers writing fine print contracts that the average policyholder can’t understand. Insurance companies may deny claims for a number of reasons.

Policy Limits

When you select your policy, you agree to certain financial limits. For instance, maybe you insured the replacement value of your home or car.

Perhaps you wanted to save money on premiums, so you insured less than the replacement value.

In that case, you would not receive adequate compensation if you have a catastrophic event that causes major damage to your property.

Even if you suffered a total loss of your home, policy limits would prevent the insurance company from reimbursing your home’s full value.

State Law Violation

Insurance companies typically will not provide coverage for a loss if the insured has engaged in some form of illegal act.

For instance, if you were driving while intoxicated and experienced an accident, your auto insurance may not pay.

Sadly, suicide falls into this category and invalidates many life insurance policies.

If you committed arson on your own home, your fire insurance might not pay.

Also, health insurance may not cover treatment related to an illegal drug overdose or injuries incurred while committing a crime.

Not Following Procedures

If you don’t follow the procedures the insurance company requires, they may deny your claim.

An insurance company may require you to file a claim within a certain time after a loss or injury.

Perhaps you didn’t file a required police report or misrepresented the events that led to the claim.

Maybe you didn’t seek medical attention immediately.

All of these problems may cause the insurance company to deny your claim.

Featured Testimonial

“The MIC showed us how to maximize out recovery from a construction defect and insurance claim. We didn’t realize we had any right to recovery before they took on our case. Thanks to them, we were able to repair our home and walked away with a sizable amount in our pockets.” Irene H.

WHAT DOES IT MEAN WHEN AN INSURANCE COMPANY ACTS IN BAD FAITH?

After you diligently pay insurance premiums, you expect your insurance company to come through for you when you have a valid claim.

Unfortunately, insurance companies don’t always hold up their end of the bargain.

Sometimes, insurance companies treat victims unfairly, a practice known as acting in “bad faith.”

Your insurance company is obligated to act in good faith when they investigate, negotiate, and settle claims.

However, insurance companies might violate this code of conduct and act in bad faith in many ways.

Fortunately, you may be entitled to additional damages and attorney’s fees against insurance companies that handle claims in bad faith.

Note that specific statutes vary state-by-state, so it’s crucial to speak to an attorney barred in that state.

Unreasonable Delays

An insurance company should act with reasonable haste in settling claims. Sometimes insurance companies delay processing a claim, hoping the claimant will just give up on it.

Most states impose time limits on insurance companies, requiring them to respond to claims within 60 days or less. This time frame varies by state.

For instance, in Texas, insurance companies have only 15 days to acknowledge a claim.

In many states, there are strict timeframes for insurance companies to pay undisputed amounts owed to the insured.

When adjusters and insurance agents cause unnecessary delays, they act in bad faith.

Failure to Investigate

Insurance companies have a duty of good faith and fair dealing. This means that when a policyholder files a claim, an insurance company must promptly investigate the claim.

The investigation must be thorough. The insurance company cannot simply dismiss a claim over the phone without investigating it.

For instance, an insurance company should investigate reports of a damaged car or roof by quickly sending an inspector.

Just as important, the insurance company owes a duty to professionally investigate your damaged property and pay you in accordance with the policy.

Deceptive Practices

When an insurance company acts deceptively, it violates its duty of good faith.

For instance, the insurance company might fail to notify you of aspects of your policy or a claim deadline.

For example, one of the issues we have dealt with is when an insurance company knowingly creates false or deceptive engineering reports or damage estimates that ignore clear damage.

If an insurance company attempts to mislead you about the legal language of your policy, they are acting deceptively.

Insurance companies should always communicate truthfully with claimants and fairly adjust claims.

Lowballing or Refusing a Claim

If a policyholder files a claim properly, an insurance company may still try to avoid paying. Sometimes, an insurance company refuses a valid claim entirely.

Other times, an insurance company may offer to pay less than the claim is worth.

For instance, maybe your house is insured for full value and is leveled by a tornado. In that scenario, the insurance company can’t offer you only half the value of your home.

Similarly, if your home was damaged by a fire or flood, the insurance company owes a duty to fully remediate the damage to a pre-loss condition.

Further, insurance companies are legally required to pay undisputed amounts within strict time periods.

Don’t fall for the deceptive, bad faith practices of some insurance companies.

An insurance dispute attorney works to make insurance companies promptly pay what they owe.

OPTIONS WHEN AN INSURANCE COMPANY DENIES YOUR CLAIM

When your insurance company denies your claim, you can evaluate whether the denial was reasonable. Insurance companies must tell you why they denied your claim. If your insurance company based their denial on a valid clause in your contract, then you may not have recourse.

On the other hand, if your insurance company unfairly denies your claim, you can respond with an appeal (with the help of a lawyer) or a lawsuit.

Question the Denial

You can appeal the denial by requesting that the insurance company conduct a full and fair review.

Make sure that you research any deadlines for asking the insurance company to clarify the reason for denial in writing.

When communicating with the insurance company, seek the help of a lawyer that will protect your interests.

Cases We Handle Dealing With Insurance Claims

File a Lawsuit

You can sue the insurance company, accusing them of acting in bad faith.

You should hire an experienced insurance litigation attorney to help you with this option.

If you win your insurance litigation suit, the insurance company will have to pay you.

You can sue the insurance company for breach of contract. This means that the insurance company did not abide by the terms of the agreement they made with you.

In some states, a bad-faith or breach-of-contract lawsuit allows you to collect attorney fees from the insurance company.

Even if the insurance company won’t pay your attorney fees, a Louisiana insurance lawyer will often work on contingency in which the attorney does not receive a fee unless they recover money for you.

INSURANCE CLAIM DENIALS YOU CAN DISPUTE

We understand the frustration you experience when an insurance company denies a claim.

However, you don’t have to give up on the claim.

Insurance companies may deny claims using unethical tactics, but the claimant is free to dispute an unfair denial.

In fact, you can dispute various reasons given for insurance claim denials.

Misinterpreted Text

The insurance company may have misinterpreted text within the policy, unfairly denying coverage. An experienced insurance dispute attorney can carefully read the policy and argue for a fair interpretation.

Unspecified Injuries

Certain injuries or procedures may not be specifically named in the policy. If an injury or procedure falls in a vague zone of policy language, your Louisiana insurance lawyer can argue for coverage.

In these types of cases, we hire an expert, such as an engineer, to help establish that coverage exists.

Incorrect or Incomplete Information

Some of the factual reporting used by the insurance company may be incorrect or incomplete. For instance, if the insurance adjuster took incorrect measurements or failed to account for damage, the facts should be reconsidered.

HOW TO DISPUTE AN INSURANCE CLAIM: PHASES AND CONSIDERATIONS

If you think an insurance company has unfairly denied your claim, you may consider disputing the denial. After reading the text of your policy, you should decide whether to move forward with reconsidering a lawsuit. Factors you’ll want to consider when making this decision include:

If you have questions about your insurance claim, it can be helpful to consult an experienced Louisiana insurance lawyer. Insurance companies may intentionally write confusing policies that are difficult to understand. An insurance dispute attorney can help you analyze complex insurance policy terms.

Once you’ve decided to move forward with a dispute, consider what resources you have to devote to the dispute. Fighting an insurance company can take a lot of time, and the financial stakes are high. When deciding whether to go up against an insurance company on your own or hire an attorney, you should consider:

You may decide to dispute the insurance company on your own at first and hire an attorney later if needed. In that case, you may encounter several phases of your dispute process.

Handling Your Claim Yourself

It is not always necessary to retain an attorney to represent you. However, if your insurance claim has been delayed, denied, or underpaid, hiring an experienced insurance attorney can be beneficial.

Alternative Dispute Resolution

Alternative dispute resolution (ADR) holds the middle ground between self-help negotiations and a lawsuit. If you use ADR, you and the insurance company can meet with a third-party mediator or arbitrator. A mediator helps you and the insurance company reach an agreement while an arbitrator holds the power to make a decision. Each method of ADR saves the time and expense of a lawsuit while allowing a neutral party to hear your dispute. However, mediators or arbitrators sometimes come from within the insurance industry, so they may be biased against you.

Note that arbitration is not common in property claims, although there is often an appraisal process in many policies we encounter.

Insurance Litigation

If handling negotiations yourself and alternative dispute resolution don’t achieve your desired result, you can turn to insurance litigation. Often, insurance companies intimidate claimants with technical language. However, an insurance dispute attorney can interpret this language and argue persuasively for you. An insurance litigation attorney is usually able to achieve a higher settlement amount than is feasible in self-help or alternative dispute resolution. In litigation, your Louisiana insurance lawyer will attempt to negotiate with the insurance company and proceed to a jury trial if necessary.

NEED ASSISTANCE WITH YOUR DENIED INSURANCE CLAIM DISPUTE?

If you have experienced problems negotiating a disputed insurance claim, we may be able to help. Our experienced Louisiana insurance lawyer regularly goes up against big insurance companies. We see right through these big companies’ deceptive tactics, and we don’t back down until we get you money.

Contact us today for a complimentary case review. If we accept your case, we work on contingency, so you don’t have to worry about a retainer. You can let go of some stress while we work to get you the insurance settlement you deserve.